Keeping Election Year Headlines in Perspective

2024 is set to be one of the most significant years for elections around the world with 50 countries holding major elections. From the Presidential election in the United States, to the European Union Parliament elections, these outcomes will play a pivotal role in shaping the political landscape and global relations in the coming years.

As the 2024 election season heats up in the U.S. it’s natural for us humans to feel a sense of unease. Headlines, based on ‘click for revenue’ business models, scream about policy changes, tax reforms, and political drama, often leaving us afraid of how possible changes will impact their financial lives. But here is something to remember: fixating on sensational headlines can be detrimental to your financial well-being.

Political Shake-Ups

Election years are anything but boring, and so far, 2024 is no different. There have already been political shake-ups in South Africa, India, and Mexico, with things beginning to swing in Europe as well. Some regions and nations are moving toward more conservative parties, as was seen in the European Parliament and Italy, where others are shifting toward more liberal parties, like Turkey and the recent elections in the UK.

While these shifts spark additional headlines, historical evidence shows that markets tend to recover from political events assuming there is a transference of control following an election. Political shake-ups cause uncertainty and thus a possible change in plan. This often leads to short-term volatility while market participants reposition assets to ‘get in front of’ the new winners. The stock market is made up of companies. Over time, the leaders of companies are paid to grow their companies regardless of who the President is or what Congress is, or isn’t, doing. As such, generally markets stabilize following elections and continue to follow the economic cycles over the long run.

Another interesting perspective around elections is one of opportunity. Political events that cause short term implications or political events that occur in one country may have limited impact on global markets. Those with a longer term or global perspective can benefit from these possible opportunities.

The Noise vs The Signal

The Noise: Fear Mongering Headlines

News outlets thrive on sensationalism, and they know fear sells. We often receive emails from folks on both ends of the political spectrum and ironically many of the emails are making the same arguments. During election years, expect a barrage of alarming headlines. Whether it’s a candidate’s radical proposal or a geopolitical crisis, expect today’s media to amplify the noise. Remember, most of the headlines are designed to grab attention, not to provide a nuanced analysis of the situation.

The Signal: A Long-Term Perspective

Our Investment Policy Committee (IPC) will resist knee-jerk reactions and we recommend other longer-term investors do as well. Instead, especially during election years, consider the big picture. Here’s why:

Politicians’ Promises

During campaigns, politicians make grand promises. They vow to overhaul the tax system, regulate / deregulate industries, and reshape the economy. However, once in office, the reality often differs. Compromises, checks and balances, and the slow legislative process often tempers both ambition and ability. So, while a candidate’s proposals might sound radical, actual implementation could be far more moderate.

Historical Context

Look back at past elections. How many campaign promises were fully realized? Not many. The companies that make up the stock market have weathered countless political cycles, and they’ve survived. Companies continue to innovate, adapt, and grow, regardless of who occupies the Oval Office.

Company Fundamentals

Again, remember that the stock market represents companies. These companies are led by CEOs, CFOs, management teams and Boards who focus on running profitable businesses. Their decisions are based on market demand, technological advancements, and competitive landscapes – not just on political rhetoric.

Adaptability

Companies adapt to changing tax policies. If tax rates rise, they explore deductions, credits, and legal strategies to optimize their tax burden. Generally, they don’t simply fold under pressure.

What to do

The word is everywhere, but the strategy remains solid: Diversify your investment portfolio and your income streams. Don’t put all your eggs in one basket. Spread your investments and your income across asset classes, geographies, and industries. It won’t matter until it matters. Diversification assists in mitigating risks associated with not only political uncertainty but economic uncertainty as well.

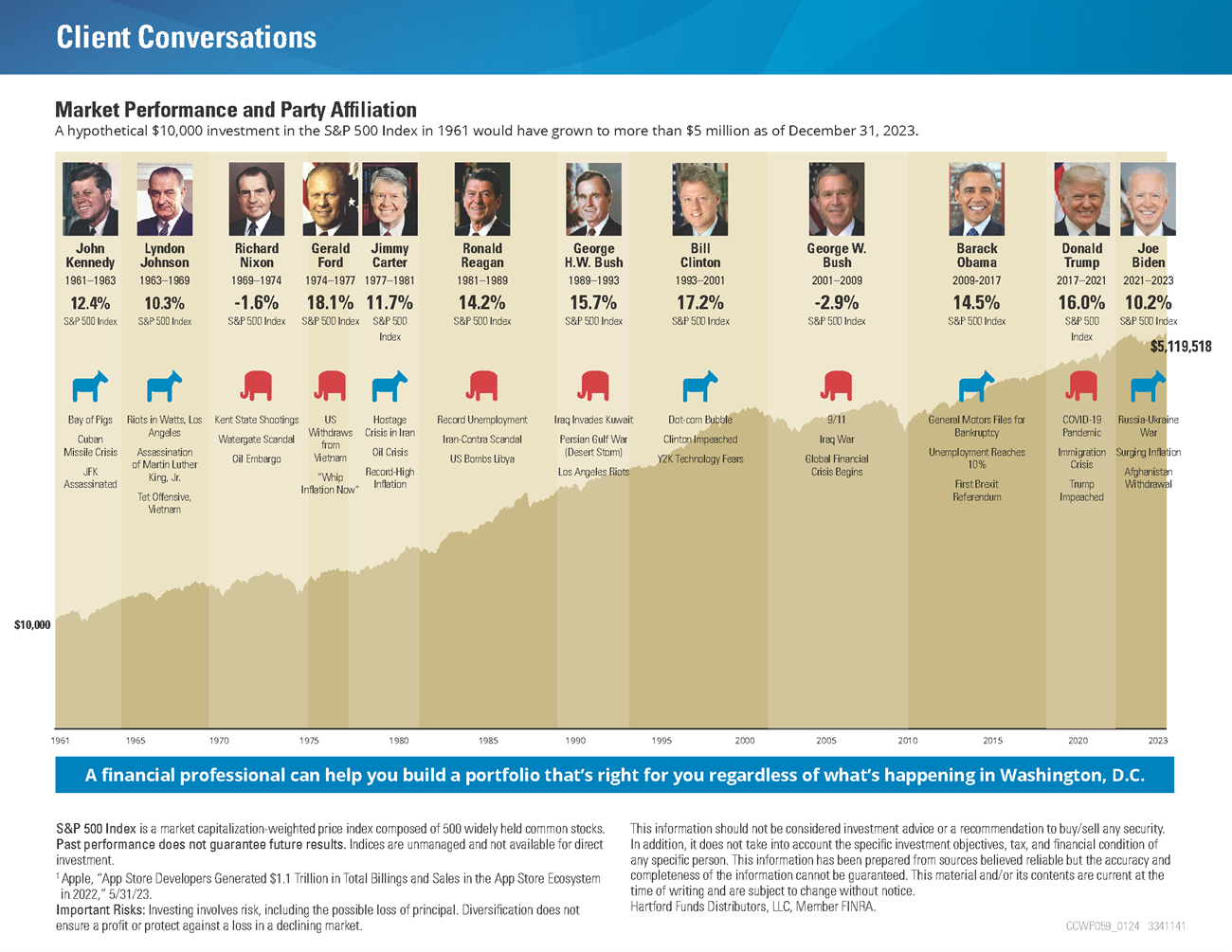

We thought the graphic above provided a good visual perspective for one asset class; and the relationship between the stock market and elections. For decades, disciplined investors have found consistent rewards in the stock market, regardless of which political party holds power. Attempting to predict market outcomes based on election results or speculative forecasts rarely yields substantial gains; in fact, it often results in costly errors. Hence, there is a compelling argument for investors to adhere to a steady investment strategy – crafting a long-term plan and steadfastly adhering to it.

In an election year, headlines will come and go. Some will be alarming, others hopeful. As a human being, it’s important to shut out the noise. As an investor, it’s important to focus on your specific objectives over the long run. Understand companies make up markets, not politicians. Keep your investment portfolio diversified. Stay informed and proactively adjust your allocation to position your assets for what is going to work – not what has worked in the past. Remember, the noise fades, but the signal – the resilience of the markets – endures. If you would like a professional to assist in this process, contact us today to begin the journey to simplification, even during an election year!

Recent Buttonwood Articles

Are you ready to explore the benefits of your very own Family CFO?