Investment Policy Committee Update - September 2024

After the stock market rally in the first half of the year and amidst the uncertainty of the upcoming election, for assets without tax implications, we are reducing risk by trimming some of the overweight for our active positions. While still in gear, we are lifting our foot from the gas pedal, still preferring stocks over bonds and select areas of risk. Seasonal weakness leading up to the election is the catalyst for us to down-size some of our bets and take gains off the table.

While we believe large cap, growth, and US stocks will continue to outperform, we are reducing our equity overweight to 1% relative to fixed income, down from a prior 4% overweight earlier in the year. We still maintain our exposure to tech and the highest earners in the market but are proceeding with caution. Historically, financial markets regularly see a rise in volatility in October. This increase in volatility is especially pronounced in presidential election years; providing further support for pruning risk in early September.

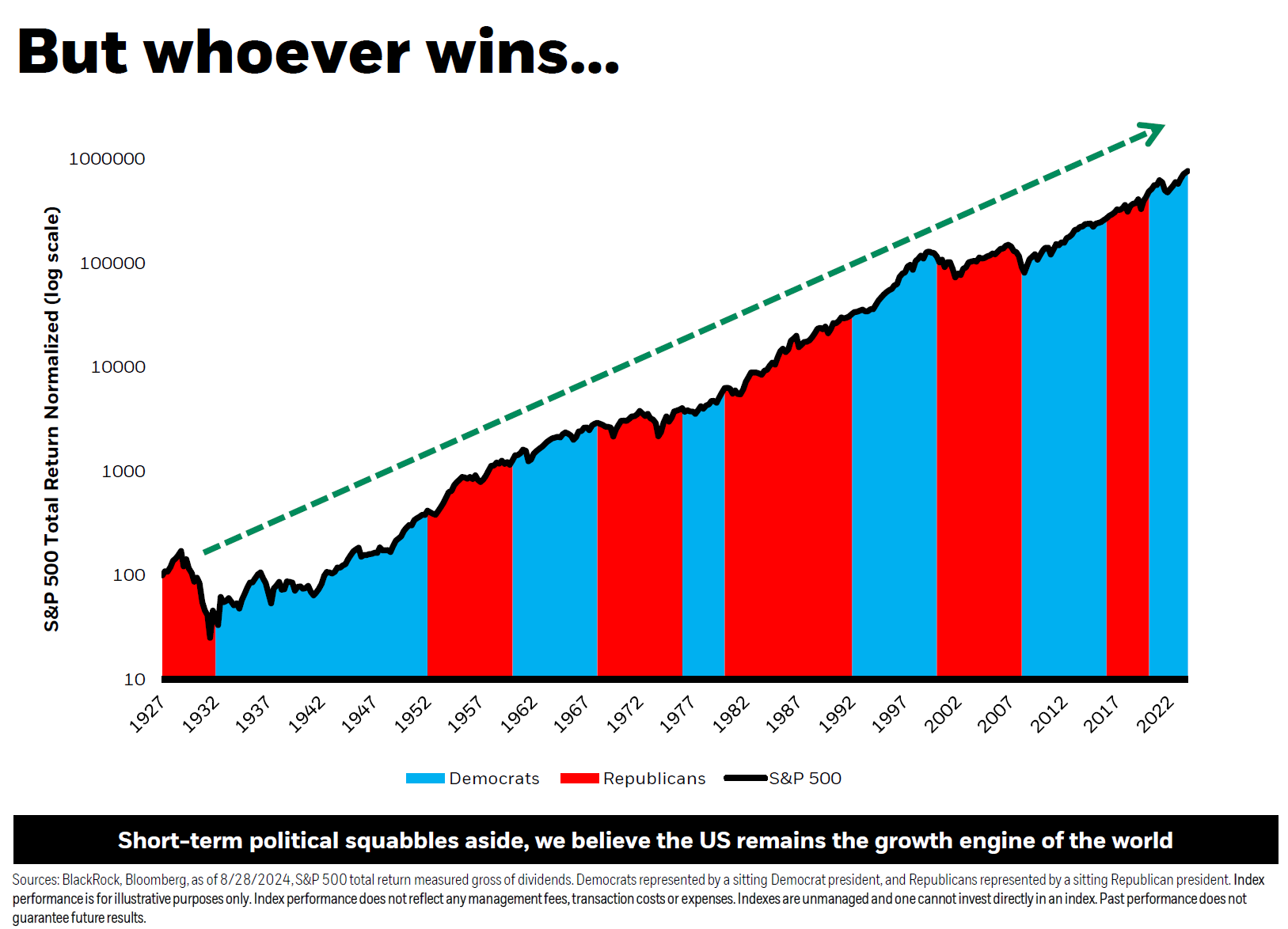

As part of our March rebalance, we discussed the bullish tailwinds we saw in the market. In June, we doubled down on the momentum. So far, the conviction has paid off, as 2024 has been a positive environment for stocks. We are taking a pause during a historically weak period with elevated risks. Assuming we have a successful election, we expect that markets will move on regardless of which party is in the white house.

Earnings have been relatively strong, yet not extraordinary this season. An unprecedented presidential contest, Fed moves, and recent volatility indicate that from here until November, there lies a path ridden with unknowns that the market will have to digest. We are trimming our US exposure due to these factors, moving closer to the benchmark on international exposure. Within our international exposure, we are also adding to developed market stocks to move closer to benchmark as part of our move to take risk off the table. We also continue to tilt into emerging markets stocks, yet continuing to exclude China.

In early 2024 we stated that we were positioning assets for multiple rate cuts in 2024. Markets have come around to that view, and we are still anticipating more cuts by year end. Historically, when the Fed cuts, there are two types of outcomes for stocks. The first is when there's a recession in the next twelve months, and stocks don't do extremely well. They still tend to have somewhat positive returns, but it’s appropriate that recessions cause underperformance. The second type, if the Fed cuts and there’s no recession, that’s typically fuel for stocks over the next twelve months. Lower borrowing costs and easier monetary policy are unsurprisingly a boon for business.

We find the second scenario to be more descriptive of the current macro environment. The uptick in unemployment and triggering of the

Sahm rule make for good headlines, but the current labor softening is primarily driven by expansion of the labor supply rather than job loss. Layoffs are still at historic lows. There would need to be substantially more softening to trigger a recession. Either way, we are cautiously bullish over the next year. 80% of the last 20 Fed cutting cycles have led stocks higher. This gives us reason to hold some of our overweight exposure to stocks and wait for the right entry point for more if we see firms benefiting from a higher liquidity environment.

Shifting from stocks to bonds, we are trimming holdings on either extreme of the curve. Inflation nearing official targets paired with softening in the labor market gives the Fed enough ammunition to embrace a dovish narrative and hint at a stark change in rate path. Our long-duration trade finally paid off as the recent bond rally priced in aggressive Fed cuts in the coming months. We are trimming that position and moving duration towards the belly of the curve.

We continue to provide these ongoing updates on our views and investment positioning through posts like this. If you have any questions about our investment strategy, please let us know and we will make sure to review details at our next meeting. While we don’t recommend fixating on short-term market fluctuations, if you would like to check specific investment performance across all your accounts, our online Orion Portal is available 24/7.

Thank you for your continued trust and allowing us to coordinate asset management as part of our Family CFO services!

Recent Buttonwood Articles

Are you ready to explore the benefits of your very own Family CFO?